Personal Credit in India: The Flipside

As discussed in our previous piece, the consumer credit and payments industry in India is experiencing rapid expansion, driven by increased activity from both established financial institutions and a multitude of fintech players. These entities are introducing innovative products, enhancing customer engagement, and improving service delivery through aggressive business models. Credit cards, in particular, have gained widespread acceptance and continue to be a popular credit instrument among Indian consumers.

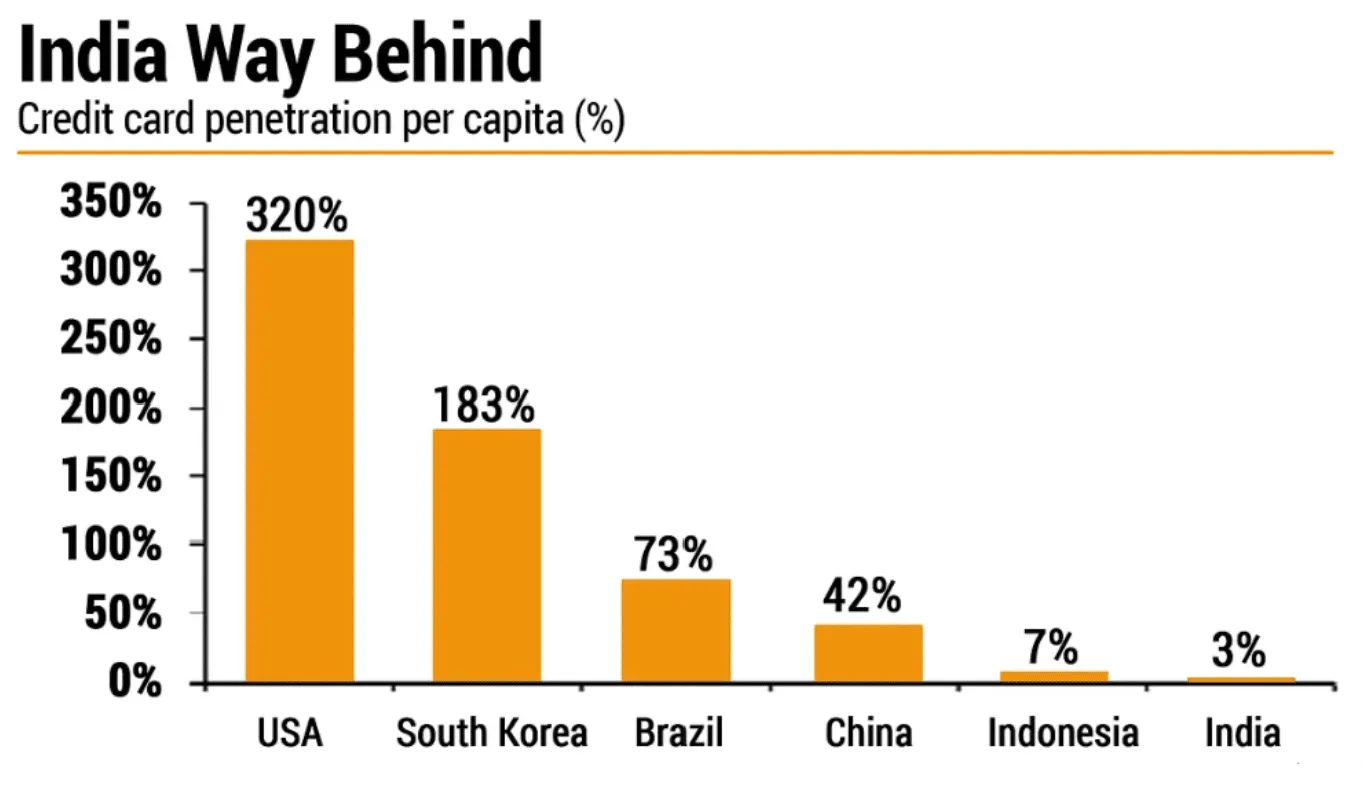

Despite this strong growth, India’s formal retail credit penetration remains significantly lower than that of global peers, indicating substantial potential for growth. The Indian market is underpenetrated because traditional financial institutions require active bank accounts, extensive documentation, and robust credit scores to sanction credit and other ancillary products.

However, the rising millennial and Gen-Z population demands digital financial flows, easier access to credit with minimal documentation, and quicker turnaround times, highlighting the need for end-to-end digital-first platforms.

Currently, the management and repayment ecosystem for credit products and allied instruments is fragmented:

- Slow turnaround times: 2-5 days for crediting periods.

- Non-rewarding repayment: No incentives for timely bill payments.

- Lack of consolidated consumer visibility across multiple credit products and their life cycles.

- Underpenetration and limited accessibility to credit cards, despite being part of the formal banking and credit ecosystem.

With increasing adoption and usage, new avenues for credit card and Buy Now Pay Later (BNPL) payments are emerging, including education, utility payments, health and fitness, and tax payments (direct and indirect, including GST). With the launch of UPI-based credit services, the credit market in India is expected to undergo a revolutionary change, making credit more accessible and convenient for both, the existing users, and the upcoming new-to-credit consumer segments. This is anticipated to lead to significant growth in the credit card market, especially for small-ticket purchases.

All-in-all, as a larger segment of the Indian population experiences upward mobility, there is a significant demand for a holistic platform focused on enabling credit health discipline and management. A surge in delinquencies and mismanagement of consumer-led credit products, along with rising credit card debt, thus underscores the feasibility and utility of a platform that empowers consumers and provides the necessary tools to better navigate their credit journey.

Global Landscape

Over the past few decades, there has been a significant rise in American consumer debt levels, particularly in areas like student loans, credit card debt, and mortgages. The inflection point in the American credit journey can be traced back to the aftermath of the 2008 financial crisis. The crisis exposed significant gaps in financial literacy and management among consumers. This mounting debt burden made it more challenging for individuals to manage their finances effectively, leading to a growing need for tools and platforms that can help them track, optimize, and improve their credit health and overall financial well-being. According to the Federal Reserve, as of Q1’2024, the total household debt in the United States is $17.987 trillion with mortgages, student loans, and credit card debt being the largest components highlighting the scale of consumer debt and the necessity for effective financial management solutions.

Over the last decade, platforms like Credit Karma, Rocket Money/Truebill, YNAB, and Mint, among others, emerged to meet this need, offering solutions ranging from credit score monitoring to expense tracking, subscription management, and lending. These platforms play a crucial role in enhancing financial inclusion by providing insights and tools that help consumers improve their creditworthiness. This is particularly important for individuals who traditional financial institutions might underserve due to a lack of credit history or other factors. By offering tools for better financial management, these platforms help prevent delinquencies and defaults, contributing to overall financial stability.

Additionally, Financial literacy programs are integrated into these apps to empower consumers to make smarter financial decisions, which can lead to more stable economic conditions at the household level. These apps also often include features that reward users for good financial behavior, such as timely bill payments and responsible credit usage, reinforcing positive financial habits. As the demand for digital financial solutions continues to rise, these platforms will remain essential in helping consumers navigate their financial journeys and achieve better financial health.

Credit Karma (Acquired by Intuit): Credit Karma was founded in 2007 during a time when many sites claimed to offer free credit scores, though none truly did. Credit Karma sought to bridge this gap by recognizing the significant value and importance of credit scores to consumers and financial institutions seeking new customers. Launched in 2008, the platform’s introduction coincided with the Great Recession, which heightened consumers' focus on personal finances, safety nets, and building sound financial habits. This economic context underscored the relevance of Credit Karma’s offerings and shaped the organization’s operational focus.

Credit Karma provides free credit scores and reports, along with educational resources that help users understand their credit health and make informed decisions. The platform addresses key financial struggles faced by consumers, such as the inability to cover bills or build a rainy-day fund, with 40% of Americans lacking such a safety net. Recognizing these challenges, Intuit identified the need for continuous customer engagement, a robust financial marketplace, and solutions to help consumers obtain better rates and resolve core financial issues. The alignment between Credit Karma and Intuit’s objectives facilitated the integration of their assets, leading to one of the biggest fintech M&A outcomes of 2020, and enhancing their ability to address these pain points and accelerate growth.

Truebill (Acquired by Rocket Money): Truebill, founded by the Mokhtarzada brothers, is one of the most remarkable success stories in fintech over the past decade. After a basement brainstorming session in Maryland, the brothers took Truebill through Y Combinator in 2016 and sold it for over a billion dollars five years later. At its inception, the personal finance space appeared saturated with established players like Mint, Credit Karma, and Personal Capital, all backed by substantial venture capital. However, the Mokhtarzadas identified a specific need unmet by existing solutions: tracking and managing subscriptions. Their focus on helping users monitor and cancel recurring expenses resonated strongly with consumers, driving Truebill's rapid ascent.

Truebill's core function of subscription tracking became its primary acquisition engine, attracting users by simplifying the monitoring of bills and facilitating subscription cancellations with minimal effort. The app's commitment to user trust differentiated it from competitors like Mint, particularly by refusing to sell user data and ensuring accurate data categorization. Building on this trust, Truebill expanded its offerings to include automated budgeting, savings, and bill negotiation. By 2020, Truebill had evolved into a comprehensive personal finance super-app, incorporating features like net worth tracking and credit report optimization. Despite the competition, Truebill’s low-cost subscription model and robust feature set enabled it to reach significant user milestones, demonstrating its relevance and potential for sustained growth.

Why is an Indian B2C Credit Management Platform Required?

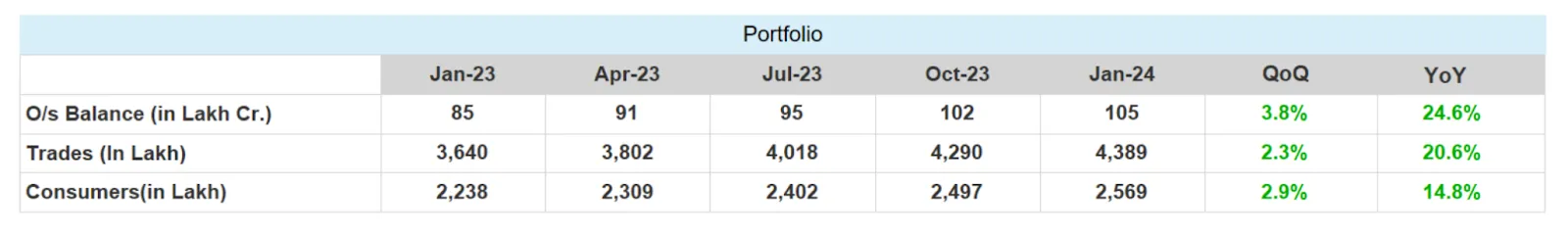

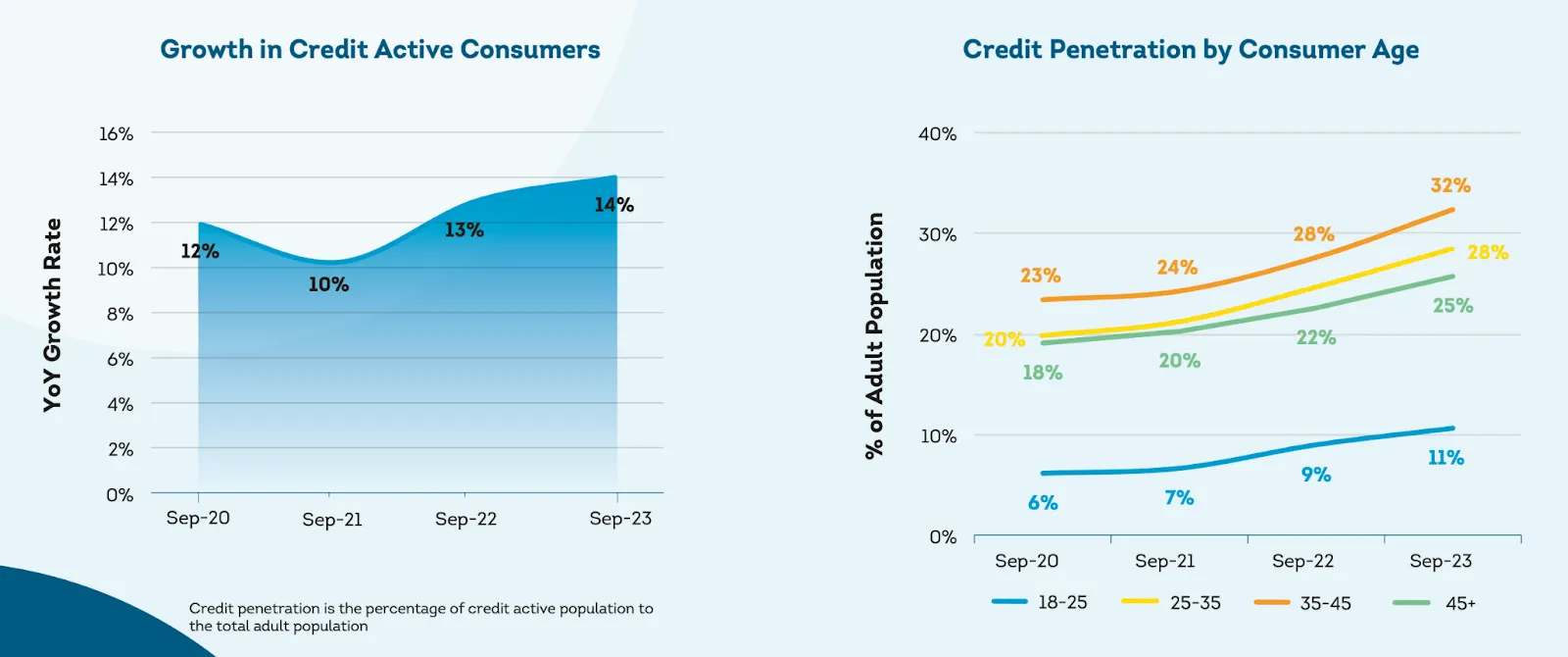

The macroeconomic environment increasingly highlights the importance of credit management, as evidenced by several key trends and data points. According to CIBIL, India’s largest credit bureau, credit penetration has significantly improved across various age groups over the past three years. These statistics underscore a broad-based increase in credit adoption across different demographics. In addition to traditional credit products, the digital lending sector has seen explosive growth. New forms of digital lending, such as Buy Now Pay Later (BNPL), peer-to-peer (P2P) lending, consumer loans, credit cards on UPI, and credit line products, have proliferated alongside conventional offerings like credit cards and personal loans.

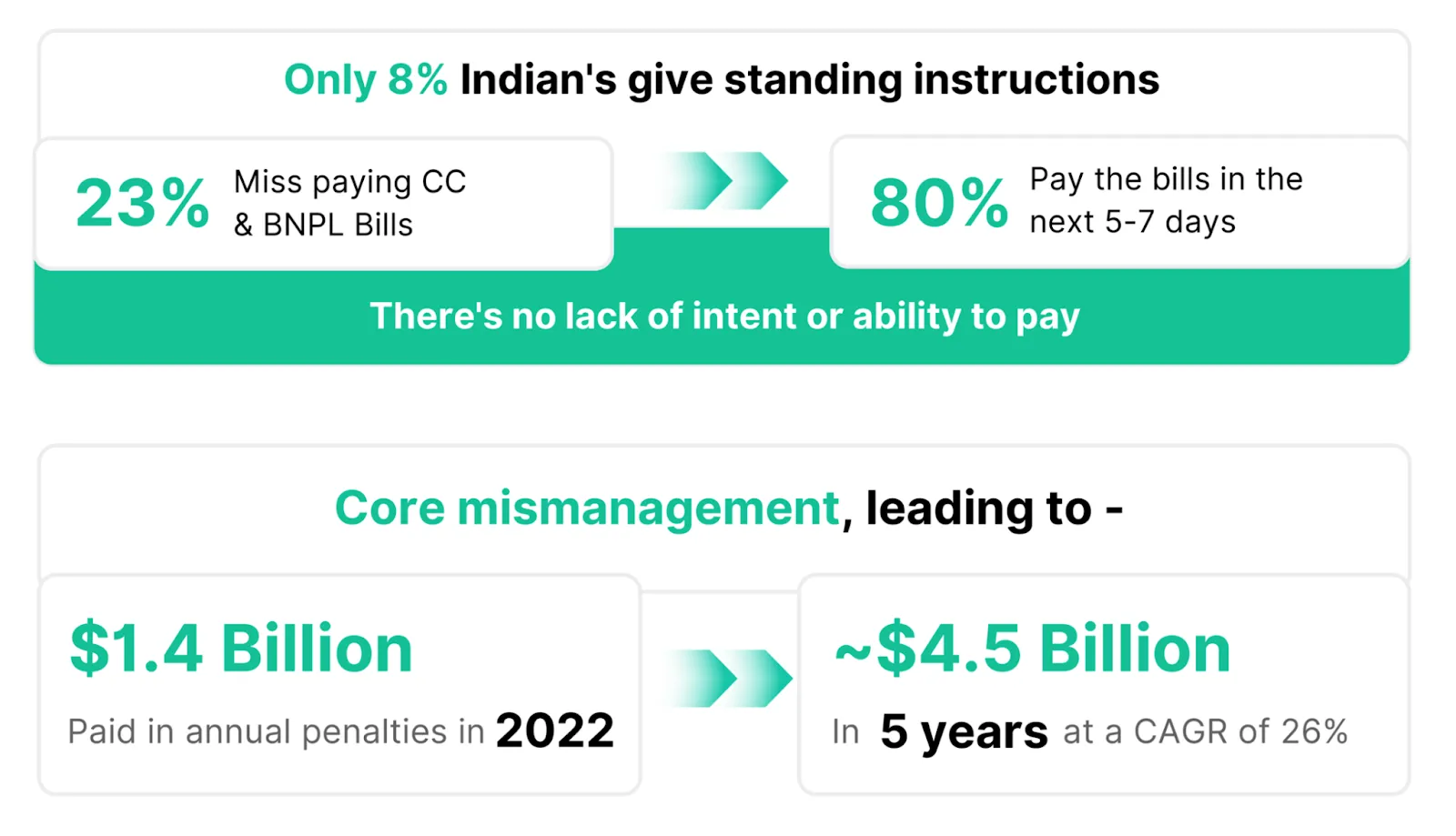

As evidenced by the data points and information collected by our portfolio company, CheQ, there is a significant segment of credit-active individuals with sub-prime credit scores who lack trust in banks, do not fully understand credit, and are generally unaware of credit management. This often leads to incidental, honest mistakes. By analyzing the impact of credit health mismanagement, which resulted in over $1.5 billion in annual penalties in CY22, estimates project a CAGR of 26%. At this rate, penalties could balloon to a staggering $4.5 billion over the next 5 years.

A. Consumer Base Expansion

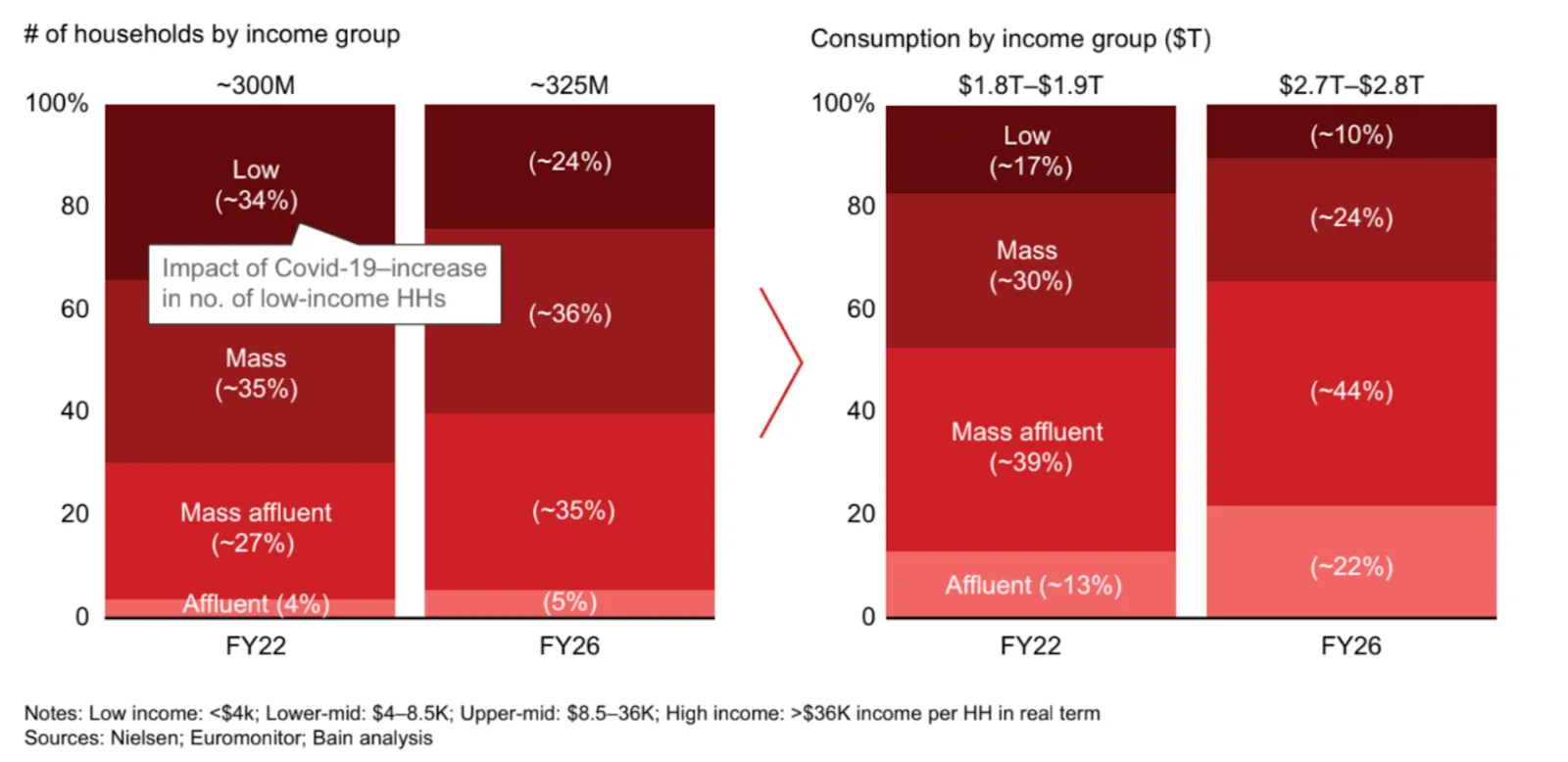

- Amid rapid economic growth, a favorable shift towards more affluent and mass affluent households (HHs) is expected to drive consumption growth in India to $2.7T+ by FY26

- By FY26, affluent & mass affluent will contribute to 60%+ consumption, due to transformation from bottom-of-pyramid to middle-class-led economy

- The addition of approximately 4 million affluent and about 33 million mass affluent households by FY26 is expected to drive 2–2.5x higher spending on essential products and 3–4x more spending on well-being services, such as education, healthcare, and entertainment, along with higher consumer durables (CDs) penetration.

- More than 40% of consumers are expected to transition to online channels for banking transactions, travel, and lifestyle purchases due to a favorable digital ecosystem and changing consumer behavior.

- Offline consumption is expected to grow at about 12% while online consumption is expected to grow at about 27%, facilitated largely through a growing share of digital payment modes, such as UPI, which is likely to make India a 50% non-cash economy by FY26. (Source: Bain & Co)

- Over the longer term, credit cards can tap customers having bureau records (credit scores). India has > 420mn customers with a credit history, of which 244 mn (58%) have a credit score of > 730, making it the prime and above customer group and the target segment for credit cards.

- US average cards per person stand at 3x - a large part of the customer pool with tax filings of > INR250k can hold 2-3 cards per person over the medium term. As of 2021, less than a third of the credit card customer base owned more than 1 card, and less than 10% of the customers owned >3 cards.

- Credit card issuers have also started issuing lower-income threshold cards, which should help in expanding the target card market. Furthermore, new segments like BNPL and UPI will only help expand the market as customers upgrade to credit cards, seeking higher credit.

- India’s credit card industry has seen healthy growth over the years, still, the market remains largely underpenetrated. The average card ownership is 5 for every 100, compared to 177 in Brazil, 57 in China, 69 in Australia, 88 in the UK, 228 in South Korea, and 325 in the USA (Source: BIS Data as of the end of 2021, updated in March 2023). Hence, there is tremendous scope for credit card adoption and usage in India and an enormous growth potential for platforms that enable credit health management.

B. Emerging Trends

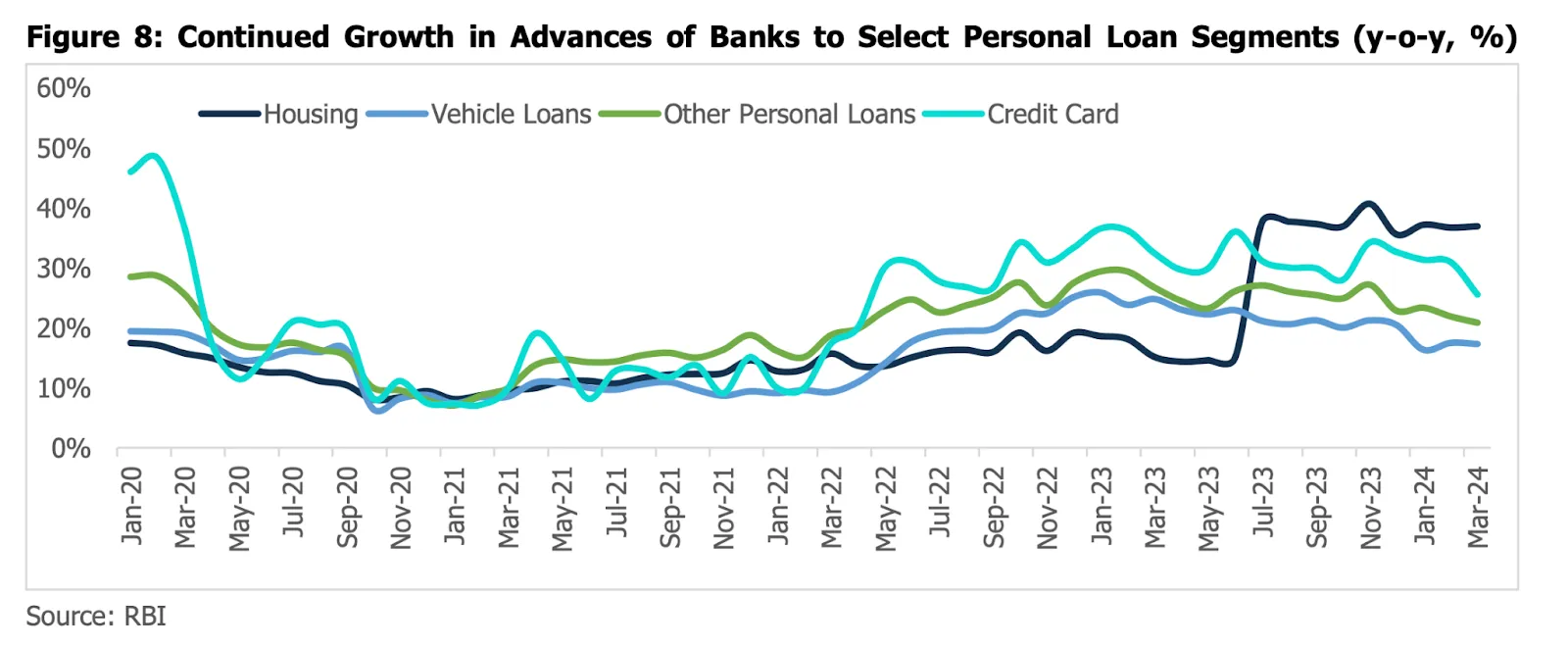

1. Retail Lending Boom

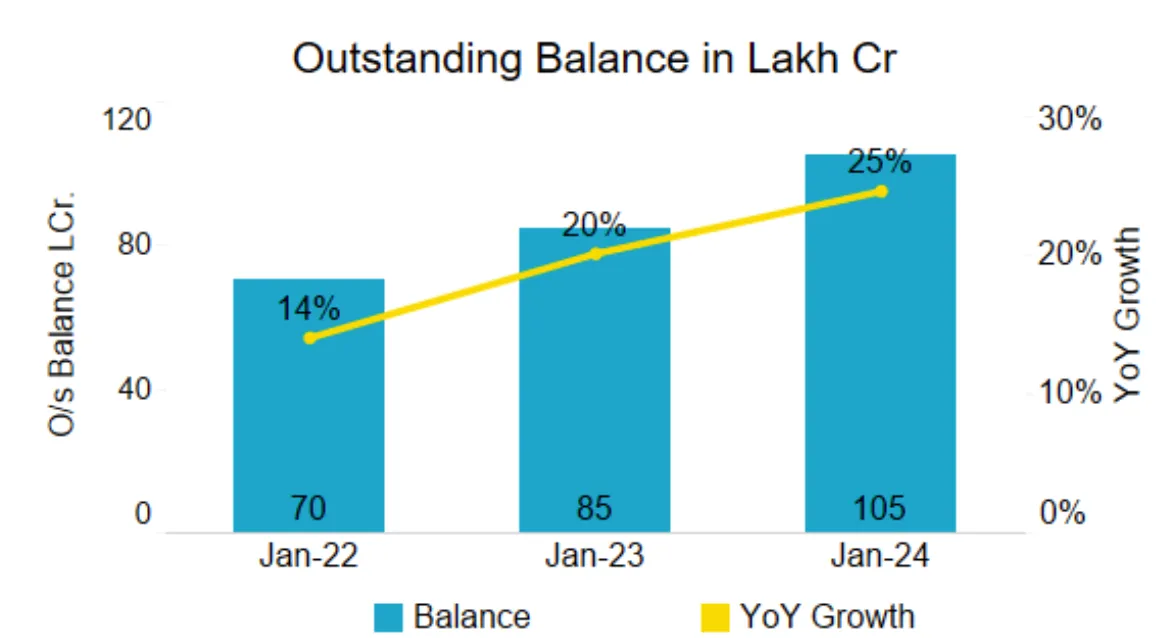

The overall retail lending market in India has experienced massive growth in outstanding balances, resulting in swelled balance sheets and aggressive advances growth. As of March 2024, total demand saw a year-over-year growth of 19%, with personal loan demand increasing by 38%. Of the total outstanding balances, 31% was in the below-prime score bucket as of January 2024.

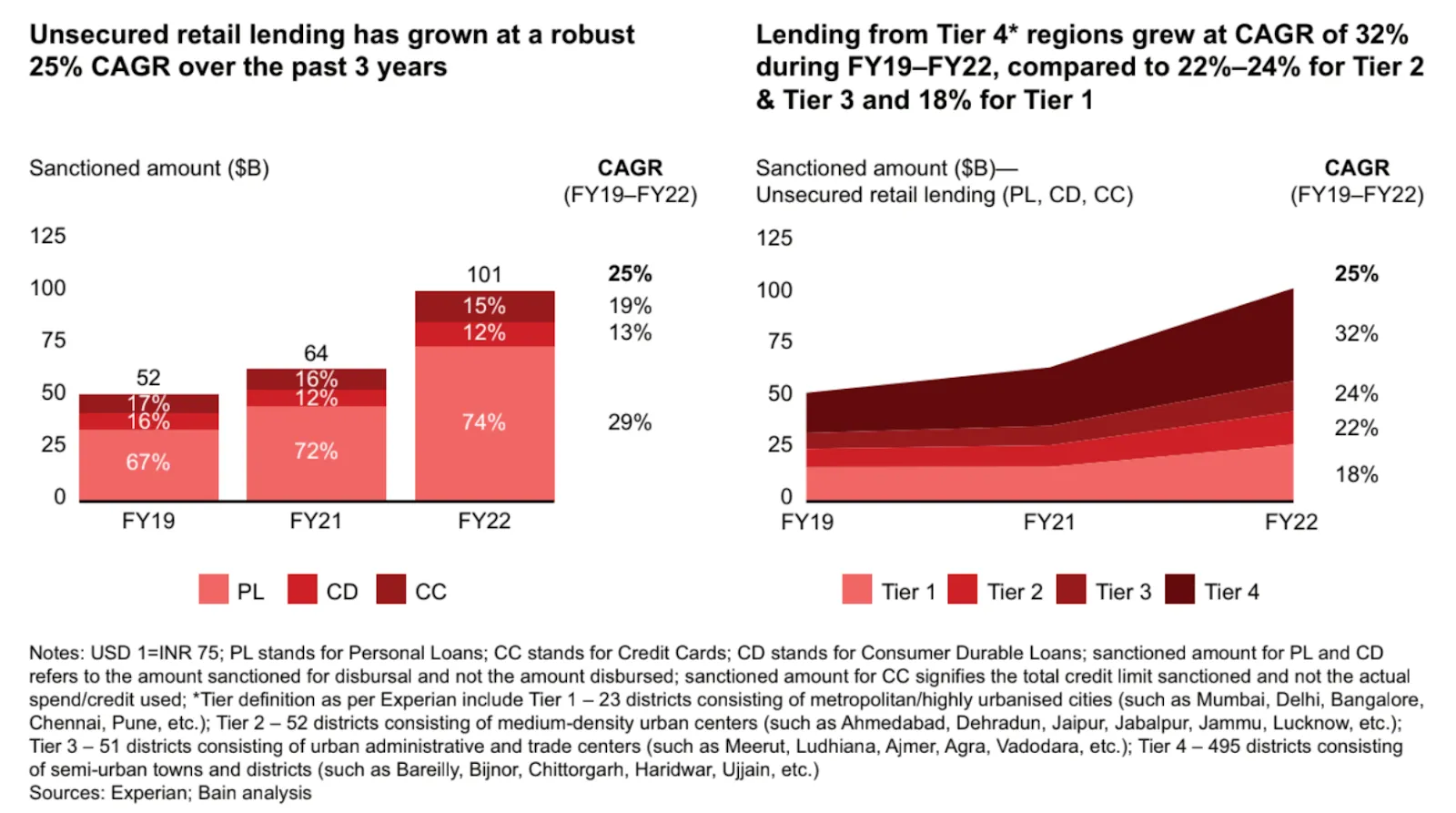

India’s unsecured retail lending market has grown at an impressive 25% CAGR over the past three years, with an increasing focus on the semi-urban regions of India. Key drivers of growth are mainly as follows —

- Semi-urban markets have been the primary source of unsecured retail lending products growth, with a ~32% CAGR in Tier 4 regions v/s ~18% CAGR in Tier 1 regions over the past three years.

- Access to small-ticket-sized loans facilitated the growth in penetration of digital credit in the millennial and GenZ audience. (Source: Bain & Co)

- Credit card issuances in smaller ticket sizes (credit limit <USD 650 or INR 50K) grew at a 12% CAGR with no significant impact on asset quality, primarily through the expansion of small-ticket loans in semi-urban regions.

- From Sep’21 to Sep’23, banks witnessed robust growth in retail loans, with a CAGR of 25.5%, outpacing the overall credit growth rate of 18.6%. This surge propelled the share of retail lending in gross advances from 37.7% to 42.2% during the same period. Additionally, unsecured retail lending expanded by 27.0%, resulting in its share in total retail lending reaching 23.3%, equivalent to 9.83% of the total gross advances of banks. (Infographic: Overall Retail Lending Mkt)

- Per TransUnion Cibil, consumers from semi-urban and rural geography tiers continue to increase their share in inquiries, with semi-urban and rural consumers accounting for 60% of originations, and younger consumers (18-30 years age group) accounting for 37% of originations.

- The CMI (Credit Market Indicator) report revealed that for the first time, consumers from the 18-30-year-old age group accounted for the largest proportion of inquiries — a measure of consumers applying for new credit— in the quarter ending September 2022. 43% of retail credit inquiries were made by consumers in the 18-30-year-old age group, compared to 38% in the same quarter in 2021, and 33% in the year before, indicating a major milestone in the evolution of India’s credit market, which now has stronger participation of younger consumers in the credit ecosystem.

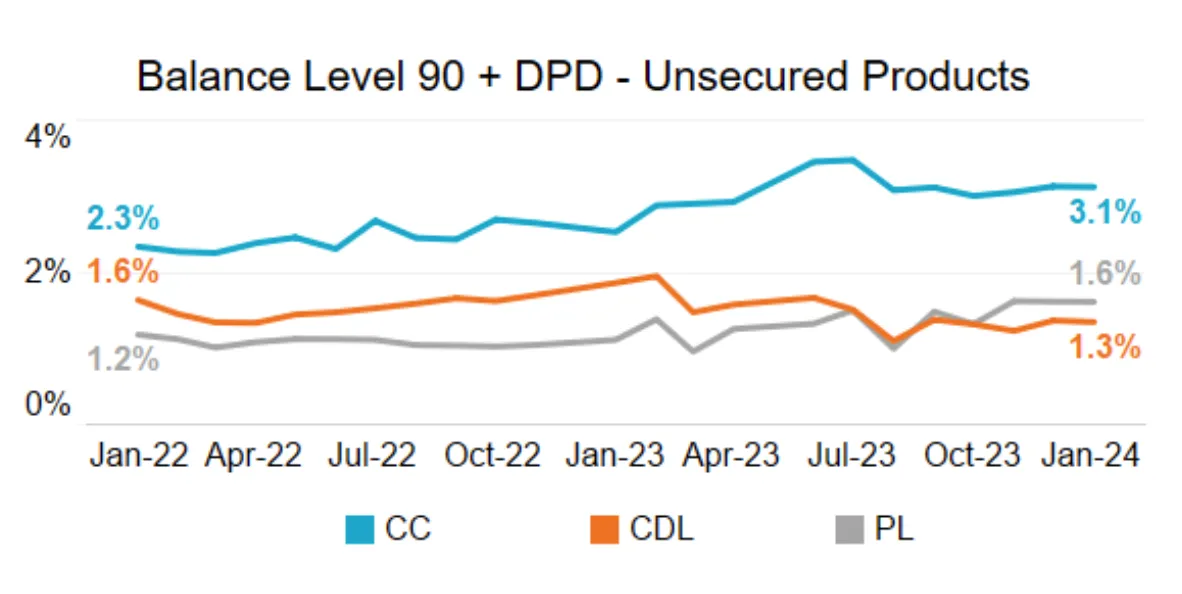

2. Need for Increased Focus on Credit Health Coverage

- In FY23, credit card defaults reached Rs 4,072 crore, marking an increase of over Rs 950 crore compared to the previous year's defaults of Rs 3,122 crore in 2021-22. This concerning trend has garnered the attention of the RBI. Following a surge in credit card spending to a record high in October 2023, RBI Governor Shaktikanta Das stated that the central bank was closely monitoring certain components of personal or unsecured loans to detect any signs of emerging stress.

- Financial Stability Report 2023 (FSR) by RBI showed that public sector lenders’ GNPA in the credit card segment was 18% & private sector banks reported a GNPA of 1.9% in FY23. Foreign banks’ credit card gross NPA ratio was 1.8% during the previous fiscal year. Bankers claim that the stress in credit card loans is mainly seen in the low-ticket segment, that is, below INR 50,000.

- Credit card payment defaults surged in June 2023, while unsecured credit portfolios and small-ticket loans have driven retail credit expansion, per TransUnion Cibil’s credit market indicator report (Source). The ‘serious delinquency’ (over 90 days past due) rate for credit cards rose by 66 basis points year-over-year, reaching 2.9%.

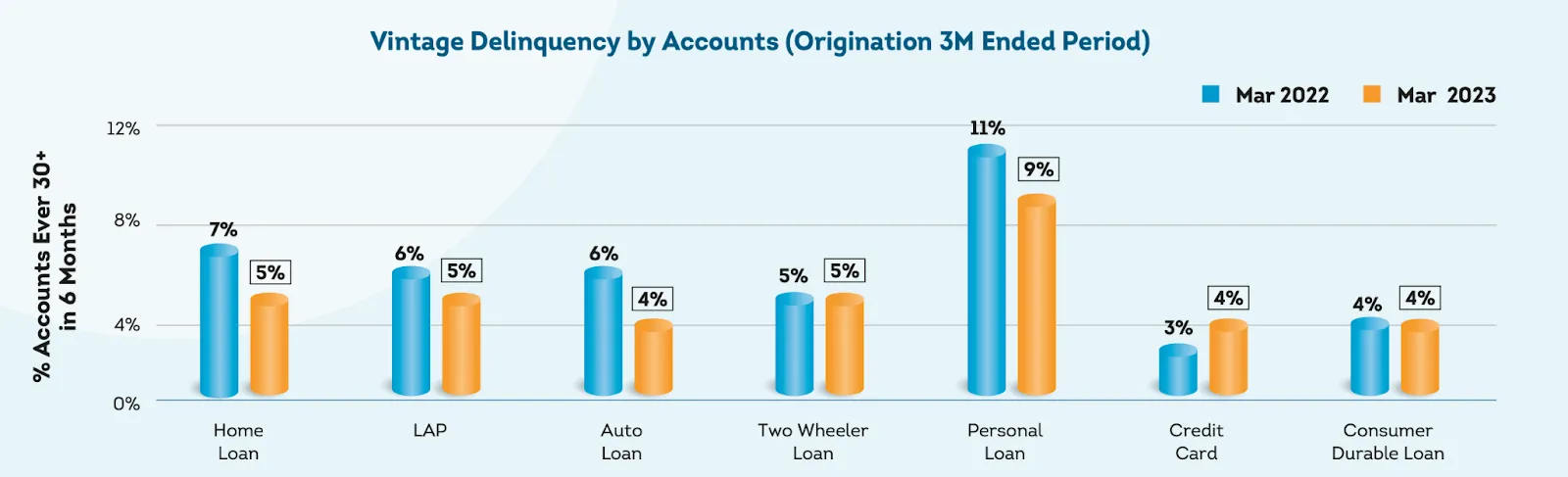

- Consumption-led products continue to have early delinquency compared to the previous year; Despite warnings from the RBI and efforts to curb unsecured lending, most of the credit card loans extended by banks have been to borrowers with relatively higher risk profiles. While early delinquency rates have declined across various products, credit cards have shown an opposite trend.

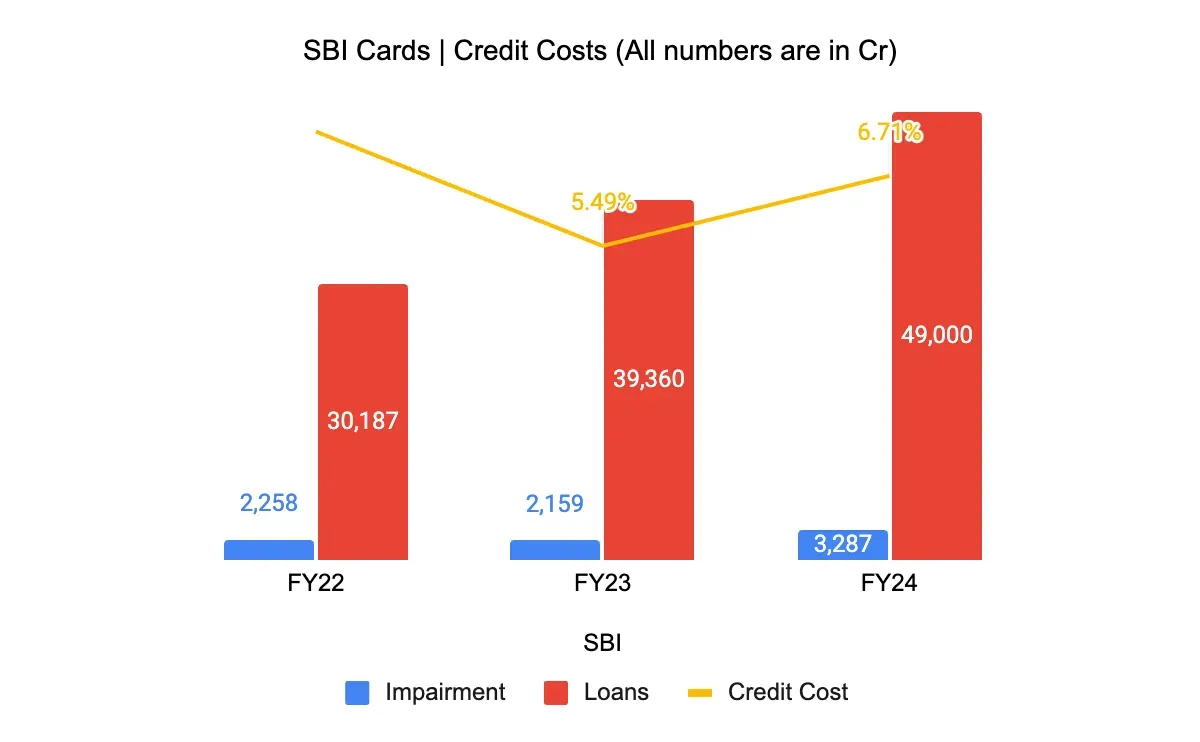

- The gross NPA ratio of SBI Cards is worsening, increasing by 12 basis points quarter-on-quarter and 41 basis points year-on-year, reaching 2.8% at the end of March. During its Q4 results call, SBI Cards announced it is implementing "corrective actions in certain geographies and customer segments" in response to "sustained delinquency flows."

- RBI economists, in an analysis of retail credit flows in November 2023, highlighted a 34% year-on-year increase in the outstanding credit card balance of banks, reaching Rs 2.4 lakh crore, constituting 5% of total retail loans. The economists emphasized that credit outstanding per live borrower tends to be higher for below-prime borrowers in the case of credit cards, indicating a greater flow of credit to borrowers with relatively higher risk profiles.

Wrap-Up

In conclusion, while the rapid growth of India's consumer credit and payments industry reflects the evolving financial landscape and increased adoption of digital financial solutions, it also underscores the critical need for comprehensive credit management platforms. As evidenced by the surge in sub-prime credit activity and the associated increase in penalties due to credit mismanagement, it is clear that many consumers lack the necessary tools and understanding to navigate their credit health effectively. Addressing these gaps through innovative, digital-first solutions can mitigate financial risks and promote responsible credit usage, ultimately contributing to a healthier credit ecosystem.The experiences from markets like the United States highlight the transformative impact that credit management platforms can have on consumer financial health. The success of platforms like Credit Karma and Truebill demonstrates the potential for similar solutions in India, tailored to meet the unique demands of its growing and increasingly digital-savvy consumer base. As India continues to witness substantial growth in its retail lending market, particularly among younger and semi-urban demographics, introducing and widespread adoption of robust credit management tools will be pivotal in fostering financial stability and ensuring sustainable growth in the credit sector.

DISCLAIMER

The views expressed herein are those of the author as of the publication date and are subject to change without notice. Neither the author nor any of the entities under the 3one4 Capital Group have any obligation to update the content. This publications are for informational and educational purposes only and should not be construed as providing any advisory service (including financial, regulatory, or legal). It does not constitute an offer to sell or a solicitation to buy any securities or related financial instruments in any jurisdiction. Readers should perform their own due diligence and consult with relevant advisors before taking any decisions. Any reliance on the information herein is at the reader's own risk, and 3one4 Capital Group assumes no liability for any such reliance.Certain information is based on third-party sources believed to be reliable, but neither the author nor 3one4 Capital Group guarantees its accuracy, recency or completeness. There has been no independent verification of such information or the assumptions on which such information is based, unless expressly mentioned otherwise. References to specific companies, securities, or investment strategies are not endorsements. Unauthorized reproduction, distribution, or use of this document, in whole or in part, is prohibited without prior written consent from the author and/or the 3one4 Capital Group.