Small Fish, Big Waters: Unpacking X-Border SMB Trade

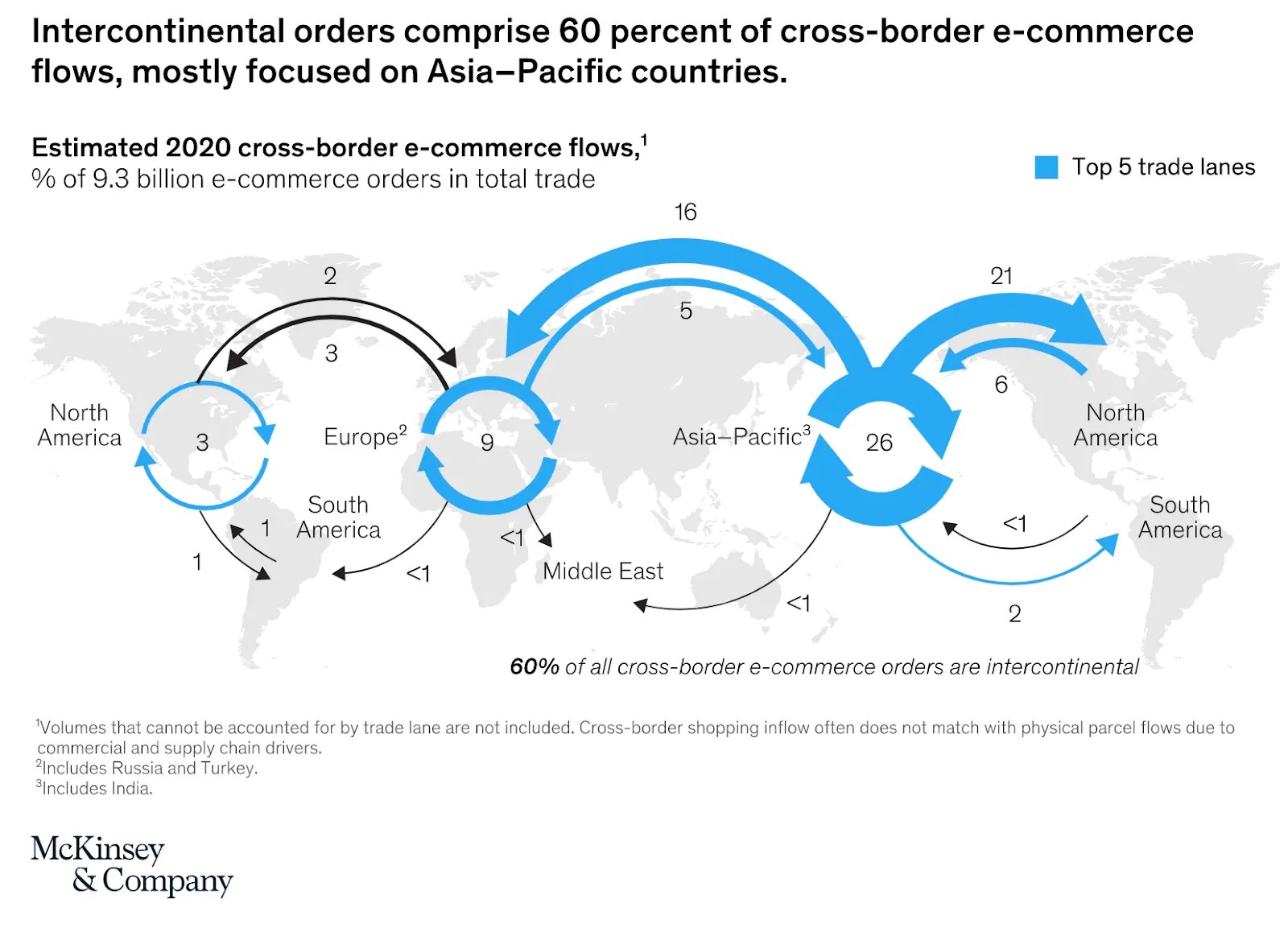

The Global cross-border e-commerce market is projected to reach $2 trillion by 2030 (Source: Euromonitor / McKinsey). Meanwhile, India's e-commerce market, currently at $80Bn+ (Source), is anticipated to surge to $350 billion by 2030, growing at a CAGR of 21.5%. This growth directly benefits SMBs in India through financing, technology, and training, and positively affects various industries. Expected to surpass the USA, India will become the world's second-largest e-commerce market by 2034.

In the realm of Indian cross-border merchandise exports, there has been a remarkable achievement, with annual exports reaching an unprecedented high of approximately $448 billion for FY23. This represents a substantial 6.03% growth compared to the previous fiscal year's record of around $422 billion in FY22 (Source: Ministry of Commerce & Industry).

Looking ahead to the future, the anticipation is that the SMBs (small and medium-sized businesses) segment will play a dominant role in Indian merchandise trade, capturing a significant 55% share by CY28, while the Enterprise segment will make up the remaining 45%. Currently, 15 million active Indian SMBs are participating in cross-border trade, a stark contrast to the 200,000 enterprises in the same space. This shift in the trade landscape highlights the growing influence and contribution of the SMB sector to the overall cross-border merchandise exports scenario in India.

Ecosystem Status Quo

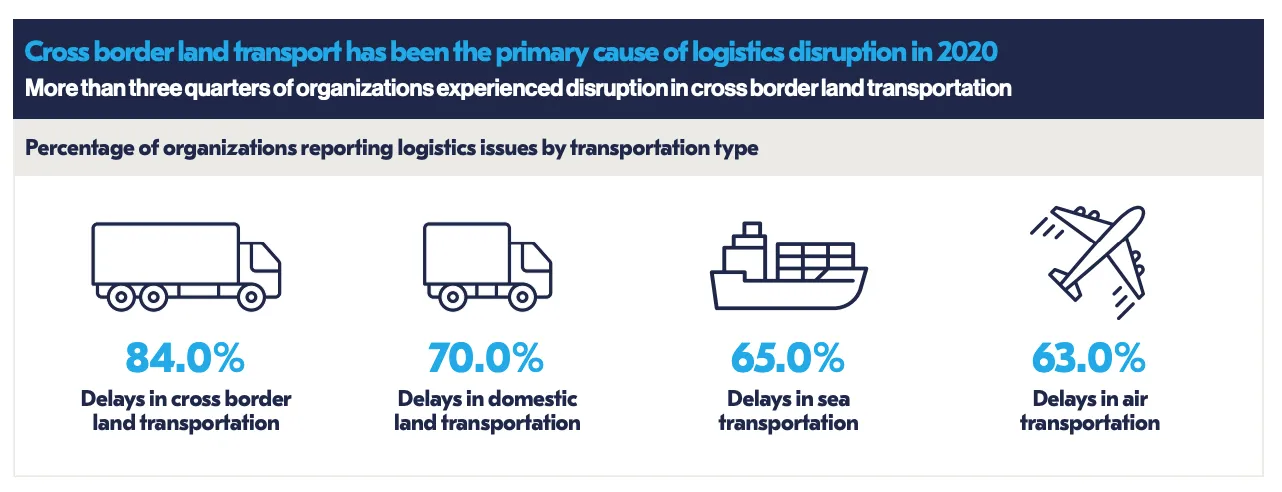

A global imbalance of containers, port disruptions caused by COVID-19 outbreaks, and a wobbly supply-demand curve as economies recovered at differing rates caused chaos in the shipping industry in 2021/22, as SMBs found themselves priced out of trade opportunities. Faced with a precarious situation, these businesses had to make the tough decision of temporarily halting shipments they couldn't afford to fulfill. Prolonged disruptions in the supply chain, coupled with insufficient income, force SMBs to either halt exports or restructure to cater to a closer market. The inability to cover variable costs becomes a significant hurdle, leading to a cessation of trade.

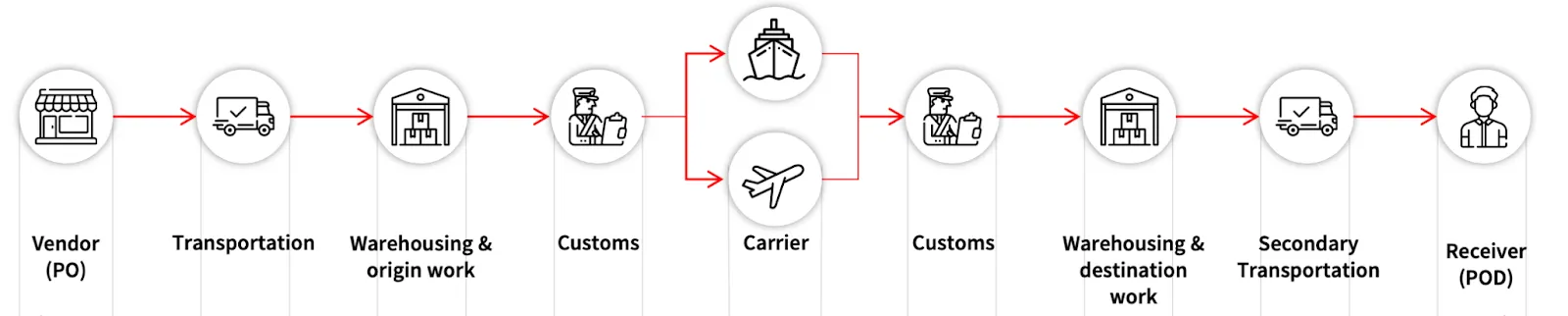

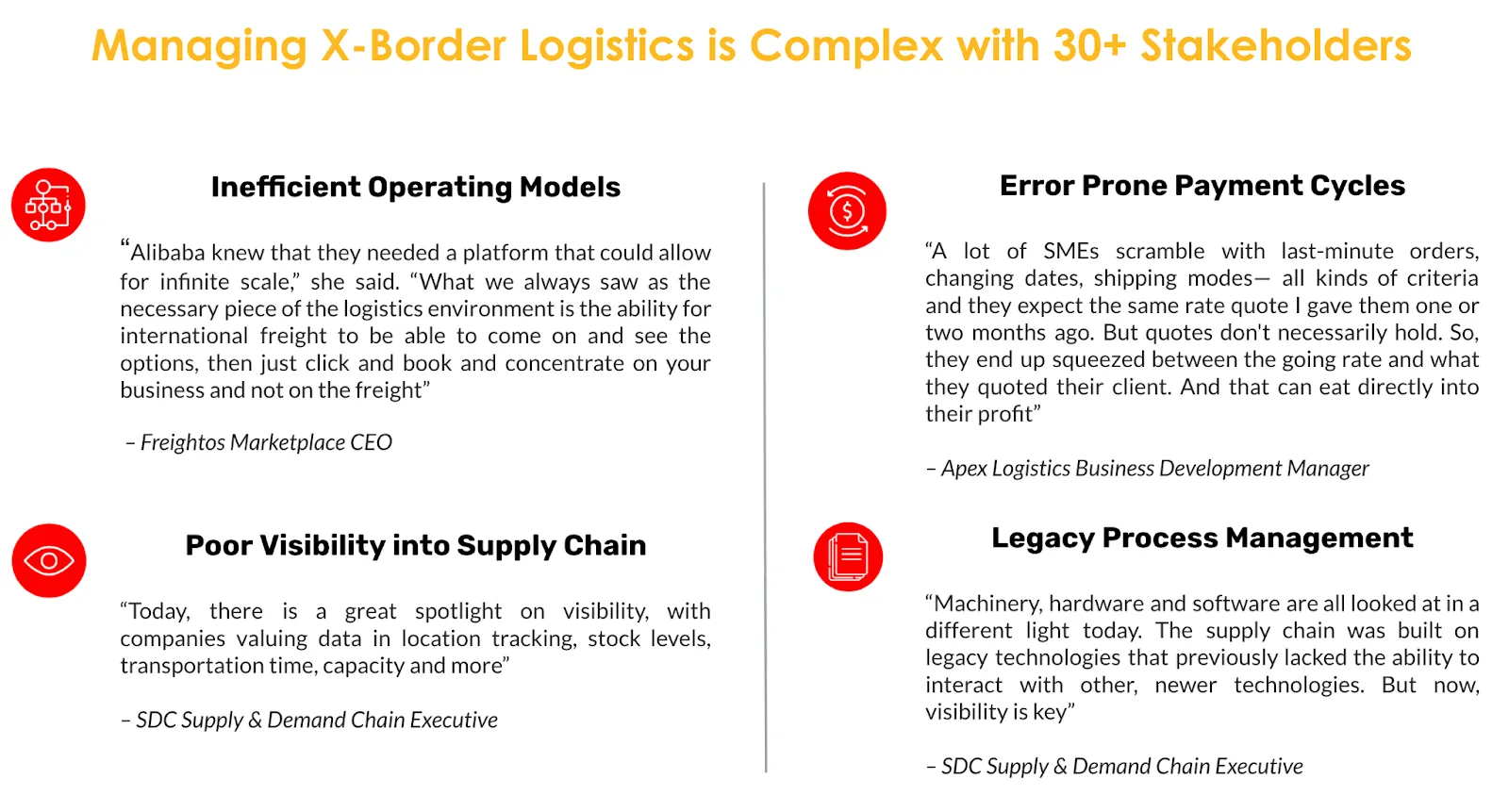

Efforts by the government to enhance infrastructure and streamline trade procedures have resulted in improved connectivity and faster shipment turnaround times. However, despite these improvements, cross-border trade in India still encounters numerous challenges. The logistics costs remain relatively high compared to other nations, posing difficulties for Indian companies to maintain competitiveness in global markets. Regulatory complexities result in delays and additional costs, compounded by the involvement of multiple parties such as exporters, importers, freight forwarders, and customs brokers. Furthermore, the lack of transparency and visibility in the process hampers exporters' ability to track shipments effectively.

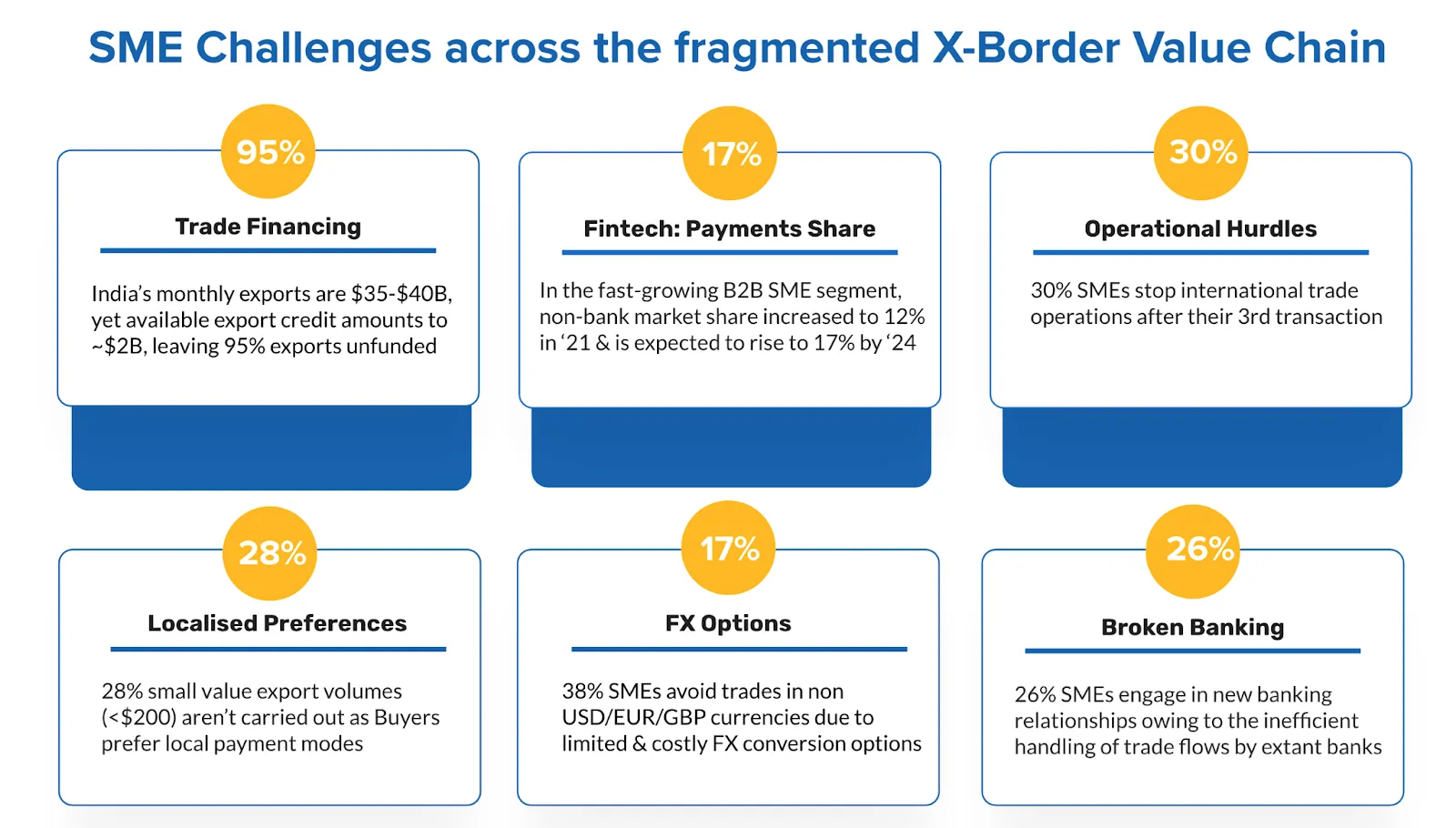

Sources: BriskPe SMB Survey, McKinsey & Co, Avendus, DBS Report.

Following the era of horizontal marketplaces such as Alibaba, TradeKey, IndiaMART, etc, which cater to various industries, product categories, and order volumes, the vertical marketplace model emerged. This model, known for its ability to reduce discovery asymmetry and onboard marketplace participants, facilitates buyer-seller interaction and allows marketplaces to expand rapidly while minimizing capital outlay. However, these marketplaces primarily focus on streamlining processes for buyers/sellers and facilitating access to raw materials and markets, with limited impact beyond that. On the other hand, traditional players like FedEx, DHL, and UPS often fail to meet modern requirements and are slow to cater to the needs of smaller businesses. These companies face difficulties in expanding margins due to high fixed costs and the need to constantly deploy additional capital to expand capacity. Additionally, they struggle to adapt to evolving market demands and fully embrace technology-enabled solutions.

While startups in India's cross-border domain have so far excelled in identifying and solving verticalized problems, such as logistics, payment solutions, market access, and freight forwarding, these solutions often offer a limited value proposition and impact potential, targeting specific segments or industries. Despite their merits, SMBs engaged in cross-border commerce still grapple with various hurdles. Using multiple verticalized solutions from different providers leads to a fragmented user experience, causing confusion, inefficiencies, and increased training overhead for businesses' employees.

Additionally, adopting and integrating multiple solutions incurs additional costs, including subscription fees, integration fees, customization charges, and ongoing maintenance expenses, which are not always feasible for SMBs with limited budgets and financial resources. Managing multiple disjointed solutions, integration complexities, and a lack of comprehensive support thus often hinders their growth. Moreover, the absence of a unified platform makes it challenging for SMBs to scale their operations effectively.

Major Gaps in the X-Border Paradigm

Ad-hoc and opaque pricing structures, coupled with limited options for selecting and booking freight partners (resulting in over 25% overhead costs), create challenges. The minimal visibility and accountability in shipping execution, coupled with multiple points of contact, intricate processes, and documentation, add to the complexity. Customs intricacies, causing 65% delays in ocean freight (Source: Avendus), further compound the situation. These factors collectively subject SMBs to laborious processes when initiating international trade. To become export-ready, SMBs often require comprehensive assistance across various areas:

- Barriers to Trade Discovery: According to the Facebook + OECD SMB Report (Source), over 60% of SMBs identify "finding business partners" as their primary obstacle to engaging in cross-border trade. The reliance on intermediaries by distributors and aggregators stems from the absence of dependable discovery options. Even in direct connections with retailers, they resort to middlemen for over 50% of product sales, bridging gaps in demand from established importers and buyers. This void impedes the acceleration of online trade, leaving both buyers and sellers reliant on intermediaries.

The absence of a structured buyer-seller-supplier network contributes to a fractured customer experience, with fewer than 20% of registered SMBs engaging in trade annually. Furthermore, a trust deficit between parties hampers the growth of SMBs. Insecure and unreliable relationships exacerbate challenges in navigating international transactions, conducting quality verifications, addressing country-specific government regulations, and securing finance through credit and escrow facilities. These hurdles often transform into formidable barriers for SMBs seeking entry into new markets.

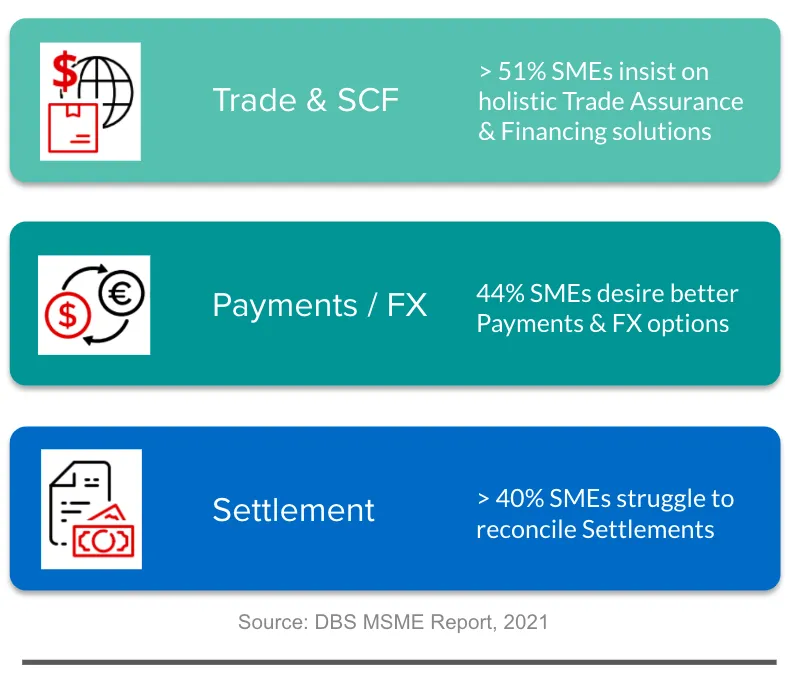

- Abysmal Payments Infrastructure: Cross-border payments and collections are hindered by numerous remittance inefficiencies and pressing demand for financing options that are separate from cargo movement. Traditional banking institutions have historically dominated cross-border payments, operating within standard flows and payment rails. According to the WTO, SMBs encounter a failure rate of 30-40% for cross-border payments, as reported by international banking entities.

- Traditionally, X-border low-value payments have experienced various challenges, among these is the significant issue of high processing fees & volatility in currency rates, which particularly affects SMBs that make small payments to their vendors and customers regularly (Source: DBS Bank). In emerging markets such as India, this is an even bigger issue for SMBs due to the use of intermediary currencies to process transactions, lack of standard regulations & compliance, and complex flows/procedures. These factors lead to higher costs of transactions, significant delays, and very little visibility for the merchant on a payment.

- Per a PayPal SMB Survey, trade costs (74%), exchange issues (31%), and managing payments fraud (30%) serve as the biggest barriers to X-border trade for Indian SMBs.

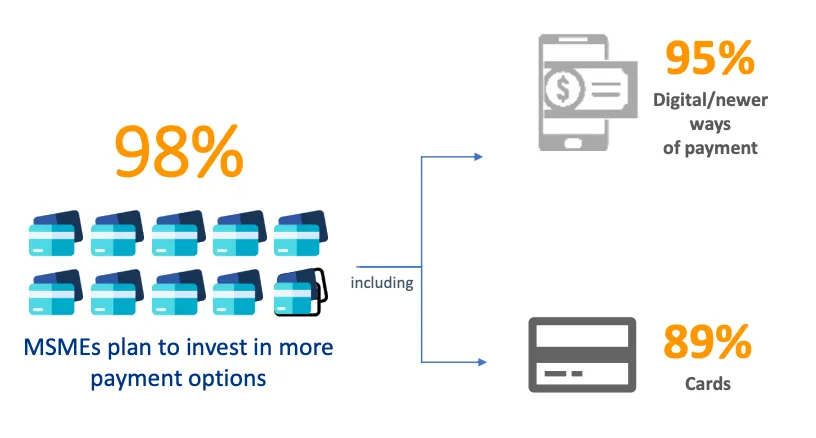

- To sell X-border, ~50% of the SMBs surveyed were looking at building an omnichannel presence by partnering with a third-party online platform and would consider implementing a global payment system to help facilitate international sales.

- Financing Conundrum: When seeking EXIM trade finance, SMBs face significant challenges, including limited access to timely and sufficient credit facilities, poor credit records, high-interest rates, and stringent conditions. The intricate procedures followed by commercial banks often result in delays and complexities, causing SMBs to miss out on opportunities for prompt credit facilities. Additionally, the exorbitant costs associated with trade finance offerings from banks make it nearly impracticable for SMBs to obtain structured funds.

- Despite India's monthly exports reaching approximately $35B-$40B, available export credit only amounts to ~$2B, leaving 95% of exports unfunded. This lack of financing restricts working capital and stifles export potential. According to the Asian Development Bank (ADB), there is a $1.5-trillion gap between trade finance demand and supply, half of which is attributed to developing Asian countries. Moreover, 70% of this gap relates to SMBs and mid-cap enterprises. Per Avendus, due to a lack of financing options, a staggering 30% of Indian SMBs cease international or cross-border trade operations after their 3rd transaction.

- Broken Trade Assurance: A notable whitespace is the lack of standardized mechanisms for ensuring trust and reliability in cross-border B2B transactions. While larger enterprises may have the resources to invest in comprehensive due diligence and legal support, SMBs often struggle to navigate the complexities of international trade agreements and regulations. This gap in access to information and expertise leaves SMBs vulnerable to fraud, contract disputes, and logistical challenges, hindering their ability to compete effectively in global markets.

- Reducing transaction risk linked to quality, shipping, damages, and payments is crucial for Indian SMBs engaging in cross-border trade. Quality discrepancies can lead to costly disputes and damage business reputations while shipping delays or damages during transit can disrupt supply chains and erode customer trust. Additionally, uncertainties surrounding international payments pose financial risks, with delayed or disputed transactions impacting cash flow and liquidity. In the absence of robust trade assurance mechanisms, Indian SMBs are left navigating these risks alone, often without the resources or expertise to mitigate potential pitfalls effectively.

The Indian international trade landscape thus presents numerous challenges and inefficiencies for SMBs, underscoring the urgent need for a comprehensive technological solution. Such a solution must seamlessly address and streamline the cross-border value chain, tackling bottlenecks and optimizing inefficient processes. Market dominance in this evolving landscape will be determined by factors such as pricing, customer experience, and quality of service (QoS).

As this category rapidly unfolds, exporters are diversifying their SKUs and sales operations across various channels. Anticipating the entry of new sellers into the trade, there's a growing demand for an advanced tech-first solution capable of managing supply-demand fluctuations, integrating seamless payments and compliance flows, alongside robust logistics & supply chain support. In this dynamic scenario, we believe that our homegrown portfolio company, XINDUS, is poised to emerge as the go-to cross-border trade enablement solution for SMBs in India.

XINDUS operates as a technology-driven global cross-border trade enabler, providing comprehensive support for SMBs to discover new markets, streamline order fulfillment, facilitate worldwide shipping, and ensure adherence to global trade compliance. The primary aim of XINDUS is to reduce costs for sellers, shippers, and SMBs by offering a holistic logistics product, exceptional customer service, and robust trade enablement support across payments, compliance, and assurance.

From the outset, their key objective has been to establish the essential infrastructure that empowers SMBs to broaden their global business presence by leveraging user-friendly supply chain technology for streamlined operational execution. Through the creation of an operating system (OS) that unifies goods flow, money flow, and assurance through data and visibility, Xindus provides SMBs with the necessary enterprise-grade technology, network access, know-how, and capital.

The versatility of Xindus' integrated network approach is poised to be a pivotal growth catalyst, setting it apart in an otherwise verticalized landscape as a solution that uniquely caters to SMBs and accelerates their operational efficiency. This strategic focus positions Xindus as a beacon in the Indian SMB narrative, instilling confidence that it will emerge as the primary destination for all cross-border endeavors within this thriving segment.

In conclusion, the landscape of cross-border trade from India presents an expanding and colossal opportunity, particularly with the flourishing SMB sector. This dynamic market, fueled by ongoing growth, provides ample tailwinds for sustainable expansion on a significant scale. It remains to be seen what innovative approaches startups will employ to meet the needs and demands of the burgeoning Indian SMB base, and the impact they will have on the overall economic well-being o the country and its people. We're privileged to closely witness and contribute to this unfolding narrative.

DISCLAIMER

The views expressed herein are those of the author as of the publication date and are subject to change without notice. Neither the author nor any of the entities under the 3one4 Capital Group have any obligation to update the content. This publications are for informational and educational purposes only and should not be construed as providing any advisory service (including financial, regulatory, or legal). It does not constitute an offer to sell or a solicitation to buy any securities or related financial instruments in any jurisdiction. Readers should perform their own due diligence and consult with relevant advisors before taking any decisions. Any reliance on the information herein is at the reader's own risk, and 3one4 Capital Group assumes no liability for any such reliance.Certain information is based on third-party sources believed to be reliable, but neither the author nor 3one4 Capital Group guarantees its accuracy, recency or completeness. There has been no independent verification of such information or the assumptions on which such information is based, unless expressly mentioned otherwise. References to specific companies, securities, or investment strategies are not endorsements. Unauthorized reproduction, distribution, or use of this document, in whole or in part, is prohibited without prior written consent from the author and/or the 3one4 Capital Group.